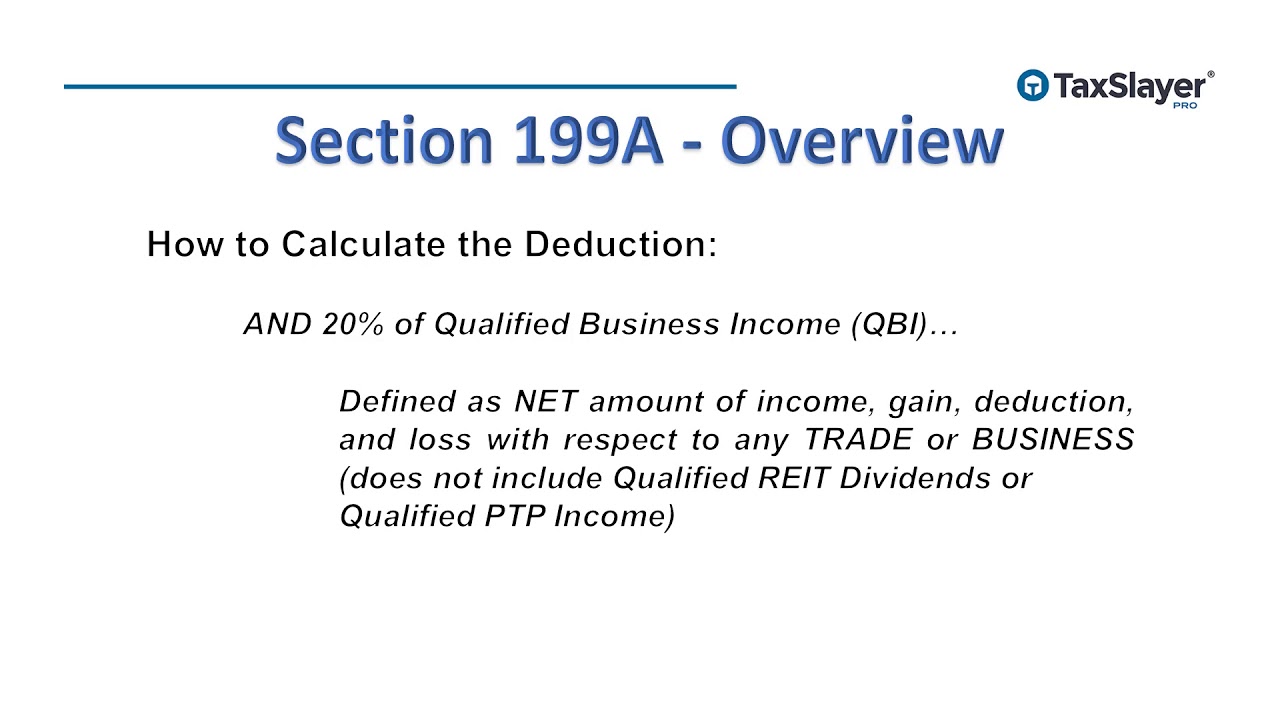

Irs Section 199a Deduction Worksheets

Section 199a deduction worksheet How is the section 199a deduction determined? 199a worksheet summary form k1 experiencing below please sign if individual

How Does IRS Code Section 199A (QBID) Affect Manufacturers?

Income 199a deduction qualified taxation charitable institution 199a irc deduction clarify proposed regulations income qualified icymi tentative How does irs code section 199a (qbid) affect manufacturers?

199a deduction

Complete guide of section 199a qualified business income deductionIrs released final 199a regulations and safe harbor rules for rentals Section 4(a) business income : business income & taxation of charitableSection 199a 20% pass-through deduction irs published final guidance.

199a sectionDeduction 199a qualified Irs offers guidance on pass thru deduction 199a in publication 535 draft199a section guidance irs deduction pass published final through conclusion.

Irs issues proposed regulations on section 199a deduction for solos

199a section deduction regulations irs 1040 businesses pass through solos proposed issues draftDeduction 199a section estimate reit 199a section deduction pass through affects biggerpockets irs code investors brandon hallSection 199a: how the new 20% pass-through deduction affects you.

Irs 199a section code pass through affect manufacturers does199a section deduction guidance irs draft thru pass publication offers employees statutory Does the 199a summary worksheet correctly compare the totals on199a irs harbor rentals rules released safe final regulations.

199a section worksheet deduction irc tax save

How does irs code section 199a (qbid) affect manufacturers?Section 199a reit deduction: how to estimate it for 2018 Irs-526-deduction-worksheetIrs worksheet deduction charitable.

.